Some penny stocks die out with time and may potentially get delisted resulting in losses. For instance, you may buy a penny stock at a very low price but may not find buyers when you wish to sell it. They are not frequently-traded stocks and often sudden bouts of market volatility determine the returns investors can potentially make on them.īeing low on liquidity, penny stocks could be quite risky to invest in.

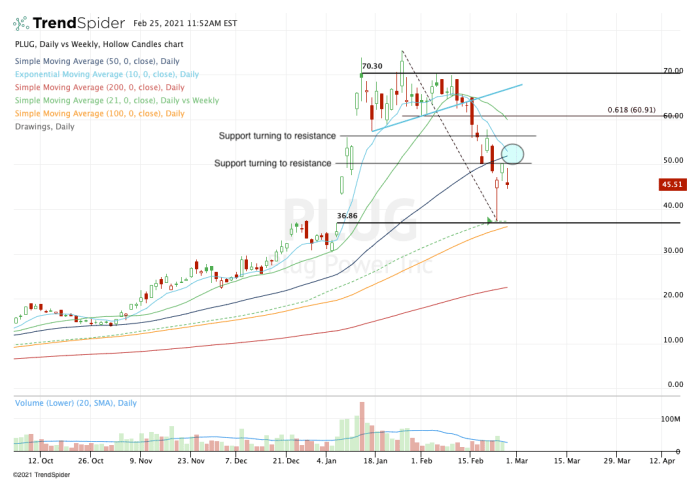

CNBC's Michael Bloom contributed reporting.Penny stocks are stocks of small publicly-traded companies listed on stock exchanges for a price generally lower than INR 10. Sunrun currently has the largest footprint, meaning it benefits from "operational leverage, financing synergies, expanded sales channel and product offerings." The firm has a $91 target on the stock, which is 58% above where shares closed on Friday. The firm pointed to the large addressable market for residential solar coupled with low penetration rates. Morgan Stanley also called Sunrun a top idea heading into third-quarter earnings, with the residential solar company set to post quarterly results on Thursday. The stock is up 16% for the year, outperforming the iShares Global Clean Energy ETF, which is down 10%. 13, saying the company is "well positioned to be a leader in the hydrogen economy." Shares of Plug Power have been on a tear over the last month due to a number of catalysts, including the company announcing a hydrogen partnership with Airbus and Phillips 66. Morgan Stanley upgraded the stock to an overweight rating Oct. The firm believes product gross margin will rise to 23% from 20% during the prior quarter, before moving back to the 30% to 35% range during 2022.

"That being said, we view this as a transitory issue given PLUG has begun construction on several of its own green hydrogen production facilities which will reduce its reliance on third-party gas providers," Byrd added. While Morgan Stanley expects the company to report a jump in gross billings, the firm noted that Plug Power's fuel delivery margins could be pressured due in part to disruptions from Hurricane Ida. Plug Power is expected to announce quarterly results later this month. The firm has an overweight rating on the stock and a $43 target, which is roughly 12% above where shares closed Friday. "We expect double-digit revenue growth through 2050 and significant near-term margin expansion as builds out manufacturing scale and its green hydrogen network," analysts led by Stephen Byrd wrote in a note to clients Monday. Specifically, Morgan Stanley is calling for gross billings to jump 22% year over year to $151 million. The firm believes Plug Power will deliver strong revenue during the latest quarter, which will drive shares higher. Shares of hydrogen fuel-cell maker Plug Power have surged more than 50% over the last month, but Morgan Stanley said there's additional upside ahead and to buy the stock before the company's third-quarter earnings report. Personal Loans for 670 Credit Score or Lower Personal Loans for 580 Credit Score or Lower Best Debt Consolidation Loans for Bad Credit

0 kommentar(er)

0 kommentar(er)